A Strategic Guide to Scotland's 2026 EPC Overhaul

The Scottish Government has officially laid the Energy Performance of Buildings (Scotland) Regulations 2025 before Parliament. While the title sounds administrative, the implications for property owners are commercial, urgent, and unavoidable.

Come 31 October 2026, the current EPC regime effectively ends. We are moving from a passive, 10-year compliance cycle to a more active, transparent, and potentially disruptive 5-year cycle.

For portfolio managers and asset owners, this is not just a paperwork update. It is a fundamental shift in how asset value is measured, with new risks—and opportunities—that require immediate strategic planning.

The Headline Changes

The new regulations introduce a complete overhaul of the rating system, a reduction in validity periods, and a strict "hard stop" for old certificates.

Validity Halved

New EPCs will be valid for only 5 years (down from 10). This doubles the administrative frequency and ensures data never drifts too far from reality.

New Commercial Metrics

The single graph is gone. Non-domestic buildings will now be judged on three distinct metrics, including Direct Emissions.

The "Transaction Trap"

A specific nuance in the transitional arrangements (Regulation 38) creates a hidden risk for short-term holds or quick turnovers.

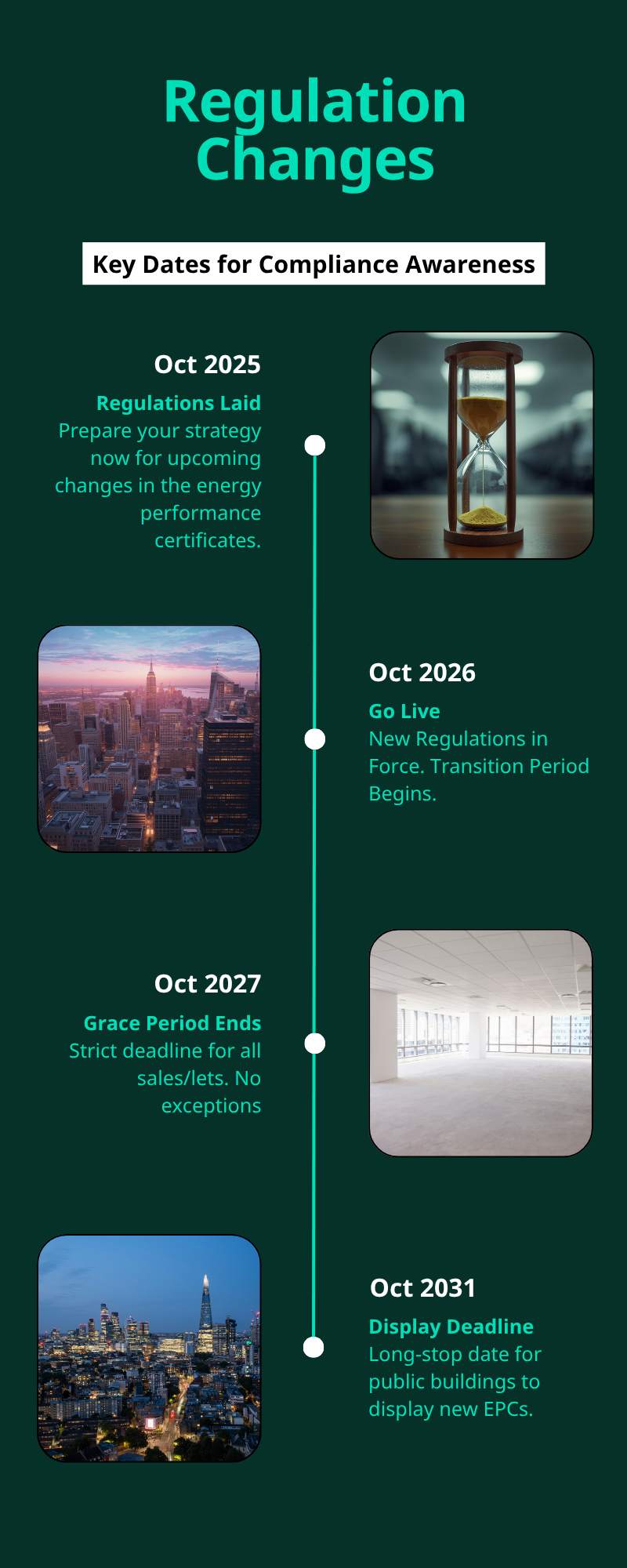

The Compliance Timeline

Your "Cliff Edge"

The regulations come into force on 31 October 2026. This date marks a "hard border" for the validity of your current certificates upon a trigger event (sale or let).

The "Transaction Trap"

Regulation 38 Matters, most property owners will look at the "one-year grace period" (Oct 2026 – Oct 2027) and relax. This is a mistake.

Regulation 38 contains a critical nuance. If you sell or let a property using an old-style EPC during this grace period, that is permitted. However, if that same property is sold or let again within that same transition year, the old EPC becomes invalid immediately.

The Scenario

Jan 2027: You acquire a building. The seller provides a valid 2024 EPC. This is compliant.

Mar 2027: You lease that building to a new tenant.

The Trap: You cannot use the 2024 EPC for this new lease. The second transaction triggers the need for a New-Style (2025 Regulations) EPC immediately.

This means asset managers cannot rely on inherited EPCs for quick turnovers or new leases from late 2026 onwards. You need a partner ready to re-assess assets immediately upon acquisition.

Commercial Real Estate

The Triple Threat

For non-domestic assets, the simple A-G graph is being replaced by a more holistic "dashboard" of three primary ratings. This aligns Scotland with Net Zero reality but exposes assets that look "efficient" on paper but are "dirty" in practice.

The "Brown Discount" Risk

The introduction of the Direct Emissions Rating is the most significant strategic shift. Currently, a modern gas boiler might help a building achieve a decent EPC rating because gas is relatively cheap.

Under the new system, that same gas boiler will result in a poor Direct Emissions Rating. While there is no immediate penalty, we anticipate that investors and tenants with strict ESG or Net Zero commitments will shy away from buildings with poor emissions ratings. This effectively creates a two-tier market, where fossil-fuelled assets carry a "brown discount" regardless of their energy efficiency.

Stay Ahead of the Curve

Don't wait for the regulations to catch you out.

Click the image below to ollow us on LinkedIn for real-time updates, deep-dive analysis, and notifications about our upcoming free technical webinars.

Deep Dive: The Technical Details

For those managing mixed-use portfolios or needing specific data on the domestic changes, here is the detail on the new calculation methodology.

Domestic Ratings: Fabric First

The new domestic EPC splits performance into three clear indicators to stop efficient boilers masking poor insulation.

Heat Retention Rating (A-G) - This measures the building fabric efficiency strictly.

Note: The government has adjusted the bands to ensure fairness. For example, a Band C is now modelled at 91-159 kWh/m²/year. This ensures that roughly 80% of homes currently rated 'C' will retain that rating, protecting early adopters.

Heating System Rating (A-G) - A simplified efficiency scale.

Band A: Heat Pumps (Zero direct emissions, >100% efficient).

Band F/G: Oil/Coal/Peat (High emissions).

Strategic Note: Gas boilers will likely cap out at Band E, visually signalling their lower status compared to clean heat.

Energy Cost Rating - A straightforward A-G rating based on running costs.

Visualising Portfolio Risk

With the validity period halving to 5 years, your compliance cycle has just accelerated. A passive spreadsheet is no longer enough to track these expiries alongside the new Regulation 38 triggers.

Compliant (New Style EPC)

At Risk (Valid Old EPC - Expires <2031)

Action Required (Transaction Imminent / Regulation 38 Risk)

How Carbon Profile Can Help

The shift from a 10-year "file and forget" document to a 5-year active data asset requires a new approach.

Our Scottish Portfolio Impact Assessment is designed specifically for this transition. We don't just lodge certificates; we model your entire Scottish portfolio against these new metrics now, before they go live.

Identify "Transaction Traps" in your lease cycle.

Model Direct Emissions Ratings to see which assets risk a "brown discount."

Budget for the 2026-2027 re-assessment surge to avoid bottleneck delays.

Contact Carbon Profile today to schedule your Impact Assessment and turn this regulatory cliff edge into a competitive advantage.